Costa Rica Private Investigator

As a Costa Rica Private Investigator, I have written this blog to look into the intriguing world of private investigation. I have done this using the background of the captivating landscapes of Costa Rica. From its lush rainforests to its serene beaches, Costa Rica offers more than just natural beauty. It’s also a place where mysteries unfold, and secrets are revealed by skilled professionals like me. I have been here for the past nineteen years and have the legal right to work here.

What is a Costa Rica Private Investigator?

Costa Rica Private Investigators are skilled individuals who specialize in uncovering information. We gather evidence and conduct surveillance to help clients solve various personal, legal, or business-related matters. Whether it’s conducting background checks, locating missing persons, or investigating fraudulent activities. I play a crucial role in resolving complex issues with confidentiality and precision.

Addressing the Role:

In Costa Rica, a private investigator navigates a diverse array of cases. Ranging from marital infidelity investigations to corporate fraud inquiries. They utilize a combination of advanced investigative techniques, modern technology, and local knowledge to deliver results that meet the unique needs of each client. With strict adherence to legal and ethical standards, these professionals provide a reliable avenue for seeking truth and justice.

Emphasizing Expertise:

As a Costa Rica Private Investigator, I possess a diverse skill set honed through years of experience and specialized training. I have a background in law enforcement, military intelligence, as well as forensic science, equipping me with the expertise needed to tackle even the most challenging cases. My ability to think critically, analyze data, and adapt to evolving situations sets me apart as a trusted ally in the pursuit of truth.

Acknowledging the Challenges:

Despite my proficiency, I face various challenges inherent to my profession. From navigating complex legal frameworks to overcoming language barriers, each case presents its own set of unique obstacles. However, through perseverance, resourcefulness, and a commitment to my client’s objectives, I surmount hurdles with determination and professionalism.

Targeting Services:

I offer a range of specialized services tailored to meet the diverse needs of individuals, businesses, and legal entities. Whether it’s conducting due diligence investigations for corporate clients or providing surveillance for personal matters, my comprehensive offerings address a broad spectrum of concerns. By customizing strategies to fit each case’s unique circumstances, they ensure thoroughness and efficacy in their endeavors.

My role is multifaceted, encompassing everything from uncovering hidden truths to safeguarding clients’ interests. Through their dedication, expertise, and unwavering commitment to integrity, these professionals serve as indispensable assets in resolving complex issues and bringing closure to unresolved mysteries. Whether you’re facing personal challenges or navigating legal matters, entrusting your concerns to a Costa Rica Private Investigator can lead to invaluable insights and peace of mind.

Just like any other country, scams in Costa Rica experience its share of scams targeting both tourists and locals. While the situation may change over time, as of my last update in September 2021, here are some

Just like any other country, scams in Costa Rica experience its share of scams targeting both tourists and locals. While the situation may change over time, as of my last update in September 2021, here are some

Costa Rica pros and cons you need to be aware of when traveling to this part of the world. Costa Rica is a popular travel destination for Americans due to its beautiful landscapes and friendly people. However, there are several

Costa Rica pros and cons you need to be aware of when traveling to this part of the world. Costa Rica is a popular travel destination for Americans due to its beautiful landscapes and friendly people. However, there are several

Just what are you looking for in Costa Rica? Trying to

Just what are you looking for in Costa Rica? Trying to

In any relationship, there are two sides to every story. What should be your expectations of a Costa Rica investigation? An investigator may consider an absurd request of a client, could stem from from simple lack of communication. During the process.on giving facts which not only satisfy the case but to satisfy the client may confusing.

In any relationship, there are two sides to every story. What should be your expectations of a Costa Rica investigation? An investigator may consider an absurd request of a client, could stem from from simple lack of communication. During the process.on giving facts which not only satisfy the case but to satisfy the client may confusing.

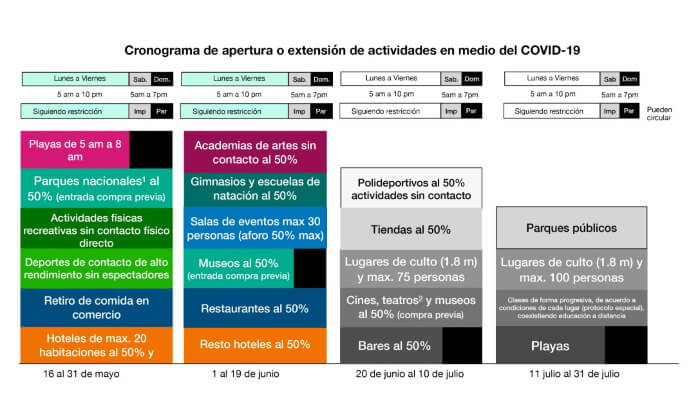

Costa Rica is once again slowly but surely returning to some sort of normalcy. It would be helpful to outline some of the new regulations after relaxing

Costa Rica is once again slowly but surely returning to some sort of normalcy. It would be helpful to outline some of the new regulations after relaxing